Archive for the ‘PCB Clone’ Category

Microsoft just edges Sony; Nintendo a distant third

Microsoft just edges Sony; Nintendo a distant third

Microsoft just edged Sony for the top position in ABI Research’s game console Competitive Assessment, based on expectations for the impact of Sony’s PS4 and Microsoft’s Xbox One game consoles.

ABI Research evaluated a number of companies across three device categories: game consoles, smart set-top boxes, and TVs/Blu-ray players. Several factors were used to score each company based on two main axes of Innovation and Implementation. The assessment provides deep insight into consumer electronics ecosystems and modern video experiences in the connected home.

Sony fell to second in the game console assessment in part because key PlayStation 4 (PS4) differentiators like cloud gaming are still untested (and won’t be fully available at launch), but largely because Microsoft has shown more features on the broader entertainment front (e.g. hybrid premium/OTT services). Nintendo secured the third position but a significant gap remains between it and market leaders.

Senior analyst Michael Inouye commented, “With the hardware specs between Microsoft’s Xbox One and Sony’s PS4 so similar this leaves Nintendo’s Wii U on the outside. If not for Nintendo’s wider distribution network, console heritage, and first party titles it would start to find itself in closer competition with many of the new market entrants.”

Not since the fifth generation of consoles have there been so many competing platforms, but unlike the past there is room for optimism. In this analysis some new platforms scored fairly well due to relatively solid foundations – e.g. Android or Valve’s Steam. Before these new entrants compete on equal ground with the incumbents; however, the markets (mobile in particular) will need to further develop and evolve.

Practice director Sam Rosen added, “As we look at the distribution of companies in this analysis it might look as if we expect a bifurcation in console gaming – a high end populated by two premium platforms and a larger pool largely based on mobile ecosystems. While this might be true in the short term we anticipate the market will come to look more cohesive than not as technologies like cloud gaming place less emphasis on the hardware and more on platforms and services.”

Read more: http://evertiq.com/news/33002

SMTC inks it with Spidercloud

SMTC inks it with Spidercloud

Spidercloud wireless scales operations with SMTC to meet demand for scalable small cell systems.

SMTC Corporation has signed a new manufacturing agreement with SpiderCloud Wireless. SMTC will provide SpiderCloud Wireless with a range of manufacturing and integrated service solutions at their San Jose, California facility to support SpiderCloud Wireless as the company scales to demands from mobile operators on a global scale.

“We chose a proven contract manufacturer with a solid reputation for upholding standards of quality and wireless technology leadership as we deliver our systems to our customers in the global theatre,” Behrooz Parsay, Senior Vice President of Engineering and Operations with SpiderCloud Wireless. “Following an extensive supplier evaluation process, SMTC’s comprehensive skill base, silicon valley NPI presence, flexibility and willingness to help us succeed, impressed us and helped us choose SMTC.“

“The communications market is a major focus for SMTC, and we’re pleased that SpiderCloud Wireless has chosen us as their global manufacturing partner,” said Larry Silber Interim President and Chief Executive Officer for SMTC. “We’re committed to supporting the growth we are currently seeing in the Wireless Communications and Networking industries in the San Jose Valley as well as globally, by partnering with innovative leaders like SpiderCloud Wireless. We have bolstered our engineering expertise to support this growth.”

Read more: http://evertiq.com/news/32887

Amazon entering a new market

Amazon entering a new market

Amazon is reportedly setting up to release its own set-top box – ready for the Christmas holiday season – to compete with the already established players.

It will be a small device – with capabilities to run apps and content from various sources – as well as being able to stream videos from Amazon’s existing services, according to a WSJ report, citing people familiar with the matter.

Amazon hasn’t made any official statements regarding its intentions for a (possible) set-top box. A release just prior to the Christmas season would give them a strategic advantage on a crowded market.

We’ve heard talks about Amazon releasing hardware before. Do I need to remind anyone of the “Kindle Phone” that’s been circling in the rumour mill since sometime last year?

But, it wouldn’t be a surprise if the set-top box actually materialised. Amazon would broaden its reach for its other services (streaming).

And looking at Amazon’s other hardware venture – the Kindle Fire – the company hasn’t done too shabby.

Read more: http://evertiq.com/news/32856

Digi-Key signs Preci-Dip

Digi-Key signs Preci-Dip

Global electronic components distributor Digi-Key signed a global distribution agreement with PRECI-DIP SA, a manufacturer of Swiss world connectors and contacts.

“Today’s engineering applications are continuously seeking new, rugged interconnect components to give them a leading edge in their markets,” said Tom Busher, vice president, global interconnect, passive, and electromechanical product at Digi-Key. “We are pleased to distribute PRECI-DIP’s spring-loaded technology, which will give our customers a cost-effective and reliable solution to their mating cycle, high shock and vibration, and board-to-board connection needs.”

“The addition of Digi-Key as a key distributor of our products provides our customers with the ability to quickly receive delivery of PRECI-DIP parts in the USA and worldwide. Digi-Key supports our commitment to meet the design needs of a diverse customer base through an easy-to-use and flexible channel,” said Tanguy Tronel, PRECI-DIP Director of Worldwide Sales and Marketing. “As the leading provider of interconnects based on screw-machine contacts for various markets, PRECI-DIP is committed to continuously expanding its global presence and service.”

Read more: http://evertiq.com/news/32752

Asset InterTech acquires Arium

Asset InterTech acquires Arium

Asset InterTech, a supplier of tools for embedded instrumentation, has acquired Arium , a California based, provider of software debug tools for systems based on Intel and ARM processors.

Arium’s debug tools will be integrated into Asset’s ScanWorks platform for debug, validation and test, making it a powerful and comprehensive non-intrusive toolset for chip and circuit board designers, manufacturing test engineers and troubleshooting support personnel.

“Arium has a long history – 35 years in fact – of developing innovative JTAG-based debug and trace tools for that layer of software between the operating system and the underlying hardware,” said Glenn Woppman, president and CEO of Asset InterTech. “Of course, faster software debug on prototypes of circuit board designs is crucial for moving designs into manufacturing sooner and accelerating new product introductions, but there is more to this beyond the tools themselves. By combining the expertise of our two organizations we are going to be able to help engineers solve a broader spectrum of problems with the kinds of non-intrusive methodologies that are best suited to today’s technology; methodologies that work from the inside out, not from the outside in.”

“We are very excited about joining forces with Asset because we’re convinced that embedded instrumentation is the technology of the future and it is well on its way to becoming a necessity for designers,” said Larry Traylor, president of Arium.

“Intel has a long history of collaboration with both Arium and Asset InterTech in enabling and validation work with our customers to bring the latest innovative Intel-based systems to market,” said Hussein Mecklai, vice president, Intel Architecture Group, general manager, Intel Platform Validation Engineering. “We look forward to continued work with the combined expertise of the two companies.”

Read more: http://evertiq.com/news/24763

Kontron hires new Head for Military, Avionic and Rail Business

Kontron hires new Head for Military, Avionic and Rail Business

Kontron AG has appointed Eric Sivertson as new head of its business unit Military, Avionic and Rail (MAR).

He joins Kontron from his current role as Founder and President of Quantumtrace. Previous positions include; General Manager at XILINX and Director of Thales Communications. Eric Sivertson will succeed Georges Batarsé, who is leaving Kontron.

“Eric is a big win for Kontron. His decades of relevant industry experience and his unique business network, especially in the US, will boost our prospects for sustainable growth significantly. This is true both in terms of the worldwide MAR business he will run for us, and in terms of the strength in our overall North American business”, says Rolf Schwirz, CEO of Kontron AG.

Kontron AG’s business unit MAR focuses on developing ECT-system solutions for the sectors military, civil aviation and regional rail transport.

Read more: http://evertiq.com/news/32704

Redondo Joins Ducommun as VP of Operational Excellence

Redondo Joins Ducommun as VP of Operational Excellence

Ducommun Incorporated has named Jerry Redondo vice president of operational excellence for its electronics and aerostructures business units.

“Jerry brings more than 20 years of leadership experience in manufacturing operations, global supply chain management, quality and lean production. He is an innovative thinker who is committed to helping the Ducommun team take operational excellence to world-class levels in our organization,” said Joel Benkie, chief operating officer.

Redondo joins Ducommun from Crane Aerospace & Electronics where he served as group vice president of operations. He previously was with the Aerospace Group of Parker Hannifin Corporation where he served as director of operations and global supply chain for the company’s Control Systems Division.

Read more: http://evertiq.com/news/32690

High-efficiency products – becoming the trend in PV industry

High-efficiency products – becoming the trend in PV industry

The market share of diversified residential market may exceed 50% in 2015, high-efficiency products are becoming the trend in PV industry

TetraSun, a high-efficiency silicon PV cell manufacturer, was merged by First Solar recently. By officially entering the silicon PV cell territory, First Solar is planning to pilot-run 100MW high-efficiency mono-si cells in 2014 and start mass production in 2015. According to EnergyTrend, a research division of TrendForce, from process equipment producers and cell module manufacturers to material suppliers, they all have come up with several solutions involving high-efficiency products. It’s obvious that high-efficiency products have become the trend in PV industry.

EnergyTrend indicates that roof-top systems have become the focus of subsidy policies, which causes the market share of diversified markets such as residential systems and small/medium commercial systems to continuously increase in Europe, North America, and Japan. Based on EnergyTrend’s estimation, the market share of diversified residential market is likely to exceed 50% by 2015. Relevant users in this market pay special attention to performance during the facility evaluation because they are hoping to replace conventional power with solar power. Relatively, the price range that they can accept is larger. Therefore, the visibility of high-efficiency products will significantly increase in the future.

Besides, since the minimum price has been set according to the new agreement between China and Europe and most of the subsidy has been allocated to the diversified residential market, it will put pressure on Chinese manufacturers that specialize in cost. Also, it will allow the countries that specialize in technology, such as Taiwan, Japan, USA, and Europe, a chance to take a break.

Judging from the spot market’s overall performance, both upstream and downstream manufacturers in China and Taiwan have accepted the price to be revised upward. Last week’s polysilicon price continues to increase with average price reaching USUSD 16.353/kg, a 0.2% rise. For Chinese domestic demand, the price range still falls between RMB 130/kg- RMB 140/kg. For silicon wafer, major silicon wafer manufacturers are planning to revise the price upward. Since they are still bargaining the price with the buyers, last week’s average price remains stable. For cell, Taiwanese manufacturers are intending to lower the price to maintain capacity utilization rate. Thus, the price continues to decline with average price dropping below USUSD 0.40/Watt to USUSD 0.398/Watt, a 0.75% decline. For module, since Chinese manufacturers are observing the development of quota allocation, last week’s lowest price turned out to be USUSD 0.55/Watt, while average price remains unchanged.

Read more: http://evertiq.com/news/32292

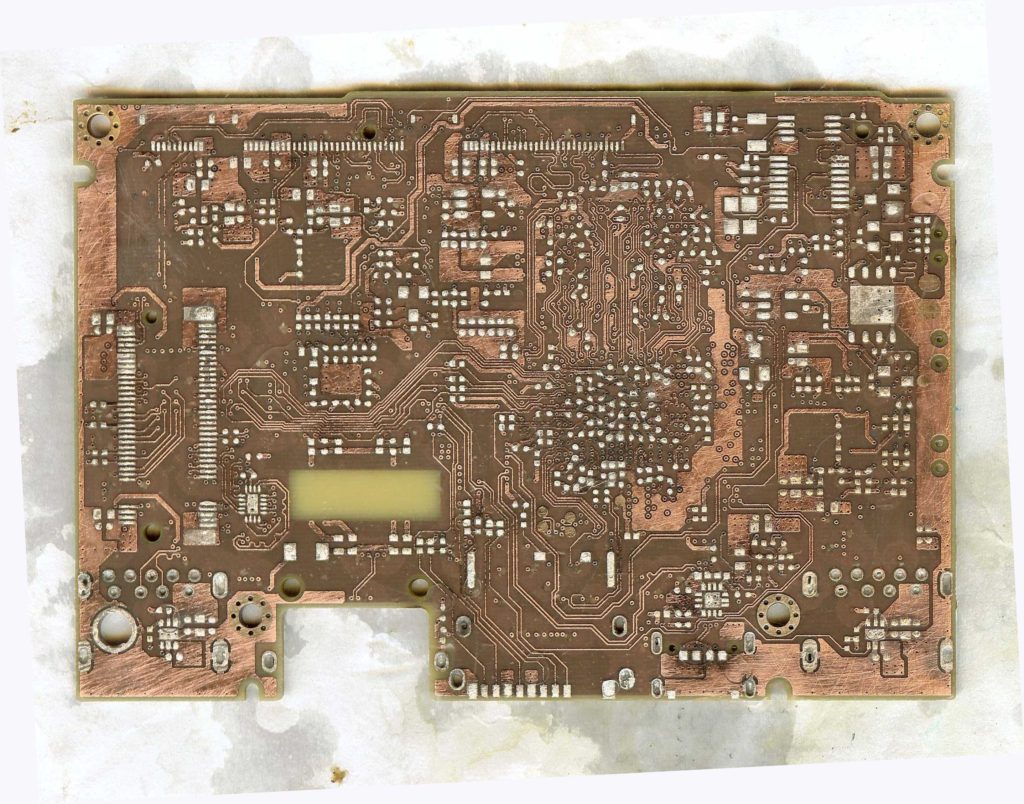

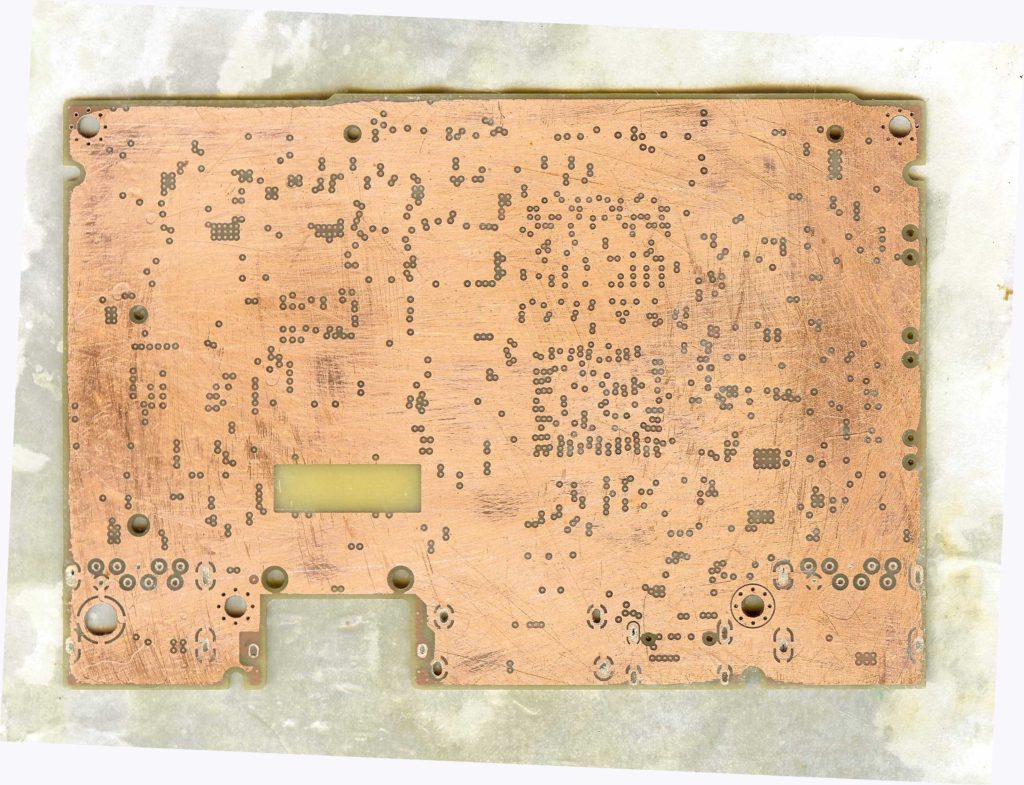

PCB Reverse Engineering Analysis and Instruction Process

PCB Reverse Engineering Analysis and Instruction Process

PCB Reverse Engineering analysis and instruction process can help to ensure the PCB board drawing documents correctiveness, the extracted schematic diagram and PCB gerber file can be used to reproduce the circuit board;

PCB Reverse Engineering’s Analysis and Instruction Process

a Functional/economic analysis should be completed to collect available documentation, determine missing data requirements, determine testing requirements, and develop the PCB Reverse Engineering service cost-Estimates and Schedules;

b. A disassembly procedure should be completed for each candidate to ensure functional integrity is maintained to allow for a viable analysis and documentation;

c. A PCB cloning service management plan should be completed for each candidate to ensure a logical sequence of events to prevent delays or misinterpretations in the overall program objectives;

d. A hardware analysis should be performed to develop the missing data required for Level 3 drawings which can be restored from embeded microcontroller memory;

e. Level 3 drawings are the result of the PCB reverse engineering service process and contain the documented parameters necessary to reproduce the selected candidate;

f. A quality control study should be performed and documented on the Level 3 drawings and prototypes of candidates to certify their compliance with original candidate specifications;

g. A production review should be performed to determine the economics of production of the electronic card reverse engineering service item;

h. Prototype production involves the manufacture and testing of prototypes to determine if they meet all required specifications; and

i. A finalized TDP should be formulated and delivered to the government/Tasking Agency requesting the PCB board copying service of the candidate item.

PCB Reverse Engineering Primary Objective

PCB Reverse Engineering Primary Objective

PCB Reverse Engineering primary objective is the development of unrestricted technical data, adequate for competitive procurement, through engineering evaluations of existing hardware.

In Process Reviews (IPRs) should be performed at the end of each principal phase of the PCB card cloning process to assure compliance to the process and to evaluate the need for continuing reverse engineering on the item.

a. Functional/economic analysis should be completed to collect available documentation, determine missing data requirements, determine testing requirements, and develop the PCB board Reverse Engineering Cost-Estimates and Schedules;

b. A disassembly procedure should be completed for each candidate to ensure functional integrity is maintained to allow for a viable analysis and documentation;

c. A reverse engineering management plan should be completed for each candidate to ensure a logical sequence of events to prevent delays or misinterpretations in the overall program objectives;

d. A hardware analysis should be performed to develop the missing data required for Level 3 drawings by restoring schematic diagram of circuit board;

e. Level 3 drawings are the result of the reverse engineering process and contain the documented parameters necessary to reproduce the selected candidate;

f. A quality control study should be performed and documented on the Level 3 drawings and prototypes of candidates to certify their compliance with original candidate specifications;

g. A production review should be performed to determine the economics of production of the reverse engineered item;

h. Prototype production involves the manufacture and testing of prototypes to determine if they meet all required specifications; and

i. A finalized TDP should be formulated and delivered to the Government/Tasking Agency requesting the reverse engineering of the candidate item.

Article quote from MLK-HDBK-115A(ARMY)